Portfolio Analysis Techniques in Strategic Management

What is Portfolio?

A Portfolio or Business Portfolio is a “collection of Businesses, Business Units and Product lines” that make up the company or an organization or a firm.

What is Strategic Management?

Every Business Firm has their own Goals & Objectives out of which the primary goal is to maximize the organization value by maximize the profit. Business must have Plan, Policy, Procedure and Framework to achieve it’s target. Those plan, policy, procedure and framework must be Implemented, Monitored, Analyzed and Improved with ongoing business activities. To achieve the goal of business, Internal and External Environment of firm must be analyzed (SWOT Analysis) to utilize the business resource in most effective manner. The above “Approach or Strategy of managing the business to align the business functions with business goals and objectives to maximize the business value using strategic evaluation techniques is called Strategic Management“.

Levels of Strategy:

- Corporate Level Strategy

- Business Level Strategy

- Functional Level Strategy

- Operational Level Strategy

Strategic Evaluation Techniques:

- Gap Analysis

- SWOT Analysis

- Value Chain Analysis

- VRIO Analysis

- Four Corners Analysis

- Financial Analysis

- PESTEL Analysis

- Product Life Cycle (PLC) Analysis

- Benchmarking

- Porter’s 5 Force Model

- Competitive Profile Matrix (CPM)

What is Portfolio Analysis in Strategic Management?

From the Strategic Management point of view, Portfolio Analysis can be defined as a set of techniques that facilitates to take strategic decisions with regards to individual business, business unit or product lines in a company’s portfolio.

Organization’s top Management identifies investments decisions and evaluates expected or obtained Returns on Investment (ROI) of various businesses, business units and product lines of the firm using Portfolio Analysis.

Using Portfolio Analysis Tool, management takes decision on which business should receive more, less or no investment and can prepare a long term/short term growth strategies. It also includes decision to add new products or business unit.

What are the Benefit of Portfolio Analysis?

7 Benefits of Strategic Portfolio Management

- Portfolio analysis helps to invest in right direction.

- Portfolio analysis helps to find out key areas of business success to focus more on.

- Portfolio analysis also identifies no profitable area to reduce resource and investment.

- Portfolio analysis tools uses graphical presentation (Balanced Scorecard) of whole firm in simple way, therefore easy to understand and communicate.

- Portfolio analysis helps to identify loop holes in business.

- Portfolio analysis helps in to achieve corporate level objective in an optimum manner.

Techniques of Portfolio Analysis in Strategic Management?

- Technological Portfolio

- ADL Matrix (Arthur D. Little Portfolio Matrix / Strategic Condition Matrix)

- BCG Matrix (Boston Consulting group’s growth-share Matrix)

- Hofer’s Matrix (Hofer’s Product-Market Evolution Matrix)

- GE McKinsey Matrix (GE Nine Cell Matrix / GE Multifactor Portfolio Matrix)

- Ansoff’s Matrix (Ansoff’s Product-Market Growth Matrix)

1. Technological Portfolio:

Image Credit: https://www.sciencedirect.com/

Technological Portfolio analysis method help to evaluate the current status of technology and continuous changes or development in the technology for the growth opportunities for the organization. The method consider the company’s position and technological attractiveness in the market for the product or strategic business unit (SBU) which helps in preparing a growth strategy.

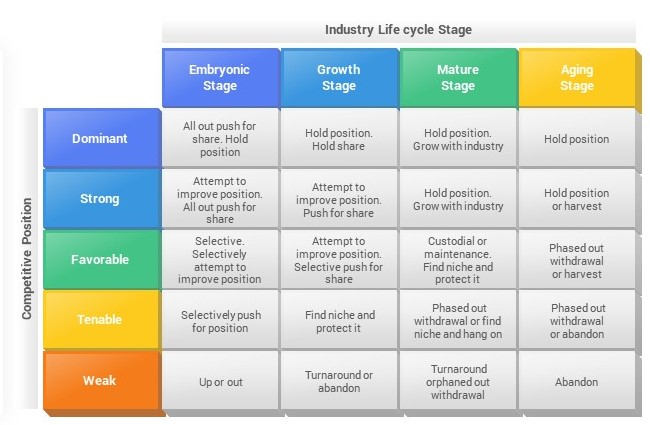

2. ADL Matrix (Arthur D. Little Portfolio Matrix / Strategic Condition Matrix):

Image Credit: https://www.slidesalad.com/

The ADL Matrix is based on Industry life cycle stage (Industry Maturity / Maturity of Product) and competitive position, which allows an organization to manage the portfolio by making the judgement of overall market situation

3. BCG Matrix (Boston Consulting group’s growth-share Matrix):

Image Credit: https://www.indeed.com/

The Boston Consulting group’s product portfolio matrix (BCG matrix) is used to help with long-term strategic planning, to help a business to take decision on growth opportunities by reviewing its portfolio of products, business units and business to decide where to invest, to discontinue, or develop products.

Based on market share and market growth level a firm can prioritize their different product, business units and business by degree of their probability.

Reference: https://www.bcg.com/about/growth-share-matrix

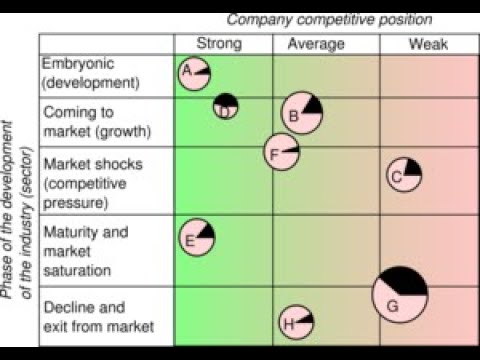

4. Hofer’s Matrix (Hofer’s Product-Market Evolution Matrix):

Image Credit: https://theintactone.com/

The Hofer Matrix is a tool to determine a company’s competitive position by identifying or analyzing internal and external factors. A firm can use this matrix to know which product(s) to put resources into.

5. GE McKinsey Matrix (GE Nine Cell Matrix / GE Multifactor Portfolio Matrix):

Image Credit: https://speakingnerd.com/

An organization can use the GE-McKinsey Matrix to consider where to invest resources and where to divest in various parts of organization. By analyzing a business unit based on its market strength and the attractiveness of its industry, can quickly see how well positioned it is for growth and potential.

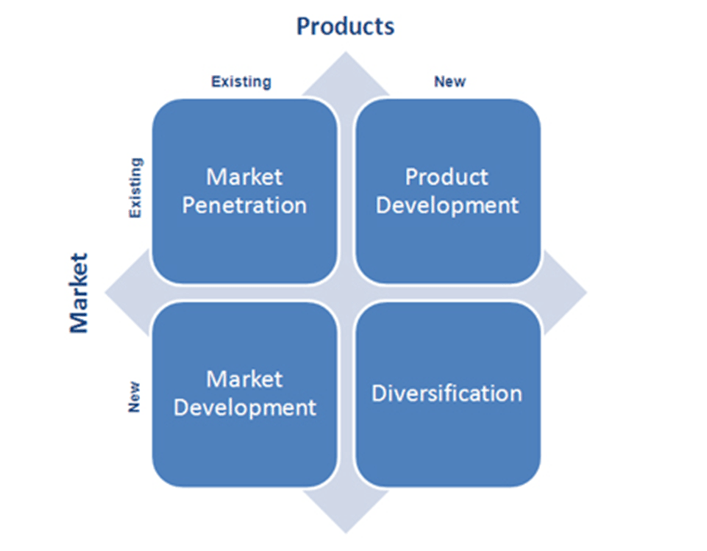

6. Ansoff’s Growth Matrix (Ansoff’s Product-Market Growth Matrix):

Image Credit: https://research-methodology.net/

Ansoff’s Growth matrix is two by two framework based on product and market condition. It helps organization to identify opportunities to grow by evaluating each option and to choose the best one.

Discover more from MicrobiteWorld

Subscribe to get the latest posts sent to your email.